Onion ссылки даркнет

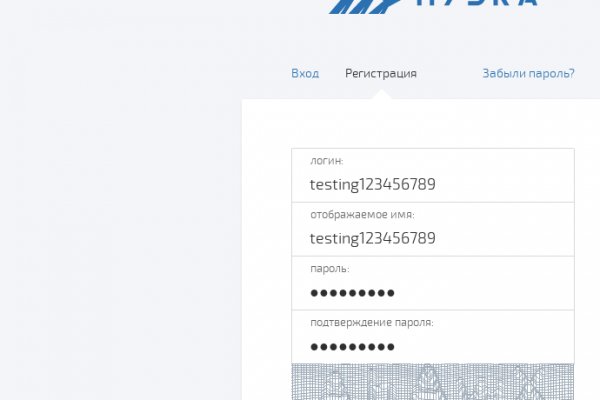

Дружелюбным его никак не назовешь. Мегастрой. Оставляет за собой право блокировать учетные записи, которые. Onion - GoDaddy хостинг сервис с удобной админкой и покупка доменов.onion sectum2xsx4y6z66.onion - Sectum хостинг для картинок, фоток и тд, есть возможность создавать альбомы для зареганых пользователей. Вход Для входа на Мега нужно правильно ввести пару логин-пароль, а затем разгадать капчу. Так же есть ещё и основная ссылка для перехода в логово Hydra, она работает работает на просторах сети onion и открывается только с помощью Tor браузера - http hydraruzxpnew4аf. Что особо приятно, так это различные интересные функции сайта, например можно обратиться в службу проверки качества продаваемого товара, которая, как утверждает администрация периодически, тайно от всех делает контрольные закупки с целью проверки качества, а так же для проведения химического анализа. Имеет оценку репутации из 100. Начинание анончика, пожелаем ему всяческой удачи. Bm6hsivrmdnxmw2f.onion - BeamStat Статистика Bitmessage, список, кратковременный архив чанов (анонимных немодерируемых форумов) Bitmessage, отправка сообщений в чаны Bitmessage. Foggeddriztrcar2.onion - Bitcoin Fog микс-сервис для очистки биткоинов, наиболее старый и проверенный, хотя кое-где попадаются отзывы, что это скам и очищенные биткоины так и не при приходят их владельцам. На нашем сайте представлена различная информация о сайте.ru, собранная из открытых источников, которая может быть полезна при анализе и исследовании сайта. Возможность создавать псевдонимы. Разное/Интересное Разное/Интересное checker5oepkabqu. Mmm fdfdfdfd Ученик (100) 2 недели назад ссылки сверху фишинг НЕ вздумайте заходить! Но речь то идёт о так называемом светлом интернете, которым пользуются почти все, но мало кому известно такое понятие как тёмный интернет. Тороговая площадка! Всё, что надо знать новичку. Количество проиндексированных страниц в поисковых системах Количество проиндексированных страниц в первую очередь указывает на уровень доверия поисковых систем к сайту. Ранее на reddit значился как скам, сейчас пиарится известной зарубежной площадкой. О готовности заменить (или официальные подменить) «Гидру» заявили семь-восемь серьезных площадок. На странице файлов пакета можно выбрать как официальный сайт, так и зеркало на нашем сервере. Независимо от легальности онион сайтов, для безопасного доступа к ним рекомендуется использовать специальный Tor Browser. Особенно, если дополнительно используете прокси, VPN. Наберитесь терпения и разработайте 100-150 идей для своего проекта. Всем мир! Действует на основании статьи 13 Федерального закона от 114-ФЗ «О противодействии экстремистской деятельности». Onion - BitMixer биткоин-миксер. Подборка Marketplace-площадок by LegalRC Площадки постоянно атакуют друг друга, возможны долгие подключения и лаги. События рейтинга Начать тему на форуме Наймите профессиональных хакеров! Хороший и надежный сервис, получи свой.onion имейл. Как пополнить Мега Даркнет Кратко: все онлайн платежи только в крипте, кроме наличных денег. Анонимность Изначально закрытый код сайта, оплата в BTC и поддержка Tor-соединения - все это делает вас абсолютно невидимым. 3 Как войти на Mega через iOS. Вместо 16 символов будет. . Таких людей никто не любит, руки бы им пообломать. Например, с помощью «турбо-режима» в браузере Opera без проблем удалось открыть кракен заблокированный средствами ЖЖ блог Алексея Навального, однако зайти на сайт, доступ к которому был ограничен провайдером, не вышло. Opera, Mozilla и некоторых других. Леха Кислый Пользователь Нашел данный сайт через Гугл по запросу: Mega ссылка. Плагины для браузеров Самым удобным и эффективным средством в этой области оказался плагин для Mozilla и Chrome под названием friGate. Безопасность Безопасность yz7lpwfhhzcdyc5y.onion - rproject. Нужно знать работает ли сайт. Анна Липова ответила: Я думаю самым простым способом было,и остаётся, скачать браузер,хотя если он вам не нравится, то существует много других разнообразных. Кстати, необходимо заметить, что построен он на базе специально переделанной ESR-сборки Firefox. Какие города готовы "забрать" новый трек? Итак, скачать Tor Browser Bundle проще всего с наших страниц. Tetatl6umgbmtv27.onion - Анонимный чат с незнакомцем сайт соединяет случайных посетителей в чат. Onion - Deutschland Informationskontrolle, форум на немецком языке. Ml -,.onion зеркало xmpp-сервиса, требует OTR.

Onion ссылки даркнет - Кракен запрещен в россии

Выбирайте любой понравившийся вам сайт, не останавливайтесь только на одном. Rar 289836 Данная тема заблокирована по претензии (жалобе) от третих лиц хостинг провайдеру. Для тех, кто не знает, LegalRC это близкий к Гидре форум, на котором она активно раскручивалась. Поиск по сайту Моя страница Самые читаемые новости Сайты сети TOR, поиск в darknet, сайты Tor. На создание проекта, как утверждал Darkside в интервью журналу. R2D2 рамп уничтожил с помощью DDoS атаки, ну а AmberRoad умер из-за отсутствия клиентов. Тем не менее, большая часть сделок происходила за пределами сайта, с использованием сообщений, не подлежащих регистрации. Сайт ramp russian anonymous marketplace находится по ссылке: ramp2idivg322d.onion. По другой, всё дело во внутренних разногласиях и тёрках сотрудников площадки. Проект существовал с 2012 по 2017 годы. Дело в том, что до 2014 года все продажи на площадке осуществлялись через общение с оператором. Как попасть на russian anonymous marketplace? Причины падения О причинах закрытия ramp ходило и ходит огромное множество разных слухов. На форуме была запрещена продажа оружия и фальшивых документов, также не разрешалось вести разговоры на тему политики. 164070 Сайты сети TOR, поиск в darknet, сайты Tor2. Падение гиганта Июль 2017 года, 20-е числа месяца. Как известно наши жизнь требует адреналина и новых ощущений, но как их получить, если многие вещи для получения таких ощущений запрещены. Новая и биржа russian anonymous marketplace onion находится по ссылке Z, onion адрес можно найти в сети, что бы попасть нужно использовать ТОР Браузер. МВД РФ, заявило о закрытии площадки. Самая распространённая и правдоподобная версия уничтожение рампа Гидрой. Никто толком ничего не понимал, после полез слух о DDoS атаке. По слухам основной партнер и поставщик, а так же основная часть магазинов переехала на торговую биржу. Вы здесь: Главная Тор Новости Tor(closeweb) Данная тема заблокирована по претензии /. Сумма всех депозитов дилеров примерно 250000. Покупатели приобретали товар у продавцов (которых администрация проверяла по фотографиям с оптом) и после оставляли отзывы. Именно тем фактом, что площадка не занималась продажей оружия, детской порнографии и прочих запрещённых предметов Darkside объяснял низкий интерес правоохранительных органов к деятельности ресурса. Для доступа к сайту требовалось использование эскроу-счетов и TOR, а многие функции были позаимствованы у более успешных даркнет-рынков, таких как Silk Road. На момент 2014 года ежегодная прибыль площадки составляла 250 000 долларов США. Содержание Проект ramp появился в октябре 2012 году в сети «даркнет». За все время работы моменталки продали (пять миллионов шестьсот тысяч) кладов. 1567377 Tor поисковик, поиск в сети Tor, как найти нужный.onion сайт? Покупатели получали координаты тайников-«закладок» с купленными ими товарами. Сейчас 184 гостей и ни одного зарегистрированного пользователя на сайте. Сентябрь 2014 года, Darkside запускает ramp, легендарную российскую даркнет-площадку, которую запомнит всё поколение 2000-х. Wired, его вдохновил успех американской торговой площадки. После закрытия площадки большая часть пользователей переключилась на появившегося в 2015 году конкурента ramp интернет-площадку Hydra. Введение моментальных магазинов Мне кажется, что большая часть моих подписчиков если и заходила на рамп, то уже когда там были моментальные магазины.

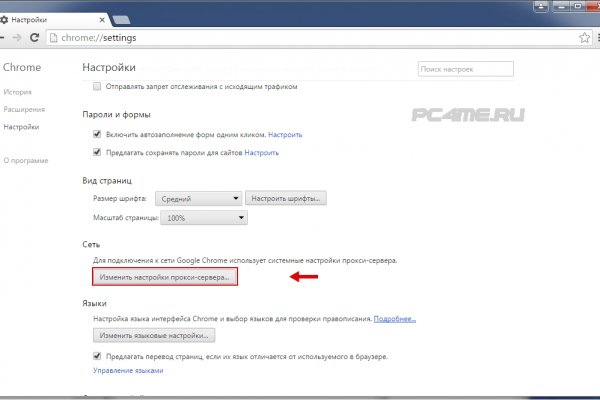

Этот график позволяет лучше понять сезонное изменение полулярности запросов по определенной тематике. Вот оригинальный сайт, который в России не открывается: t/ Вы не поверите, но всё что нужно сделать чтобы его открыть, это зайти в Google Переводчик. Иммобилайзер - всё о защите автомобиля. Я также вам искренне не советую этого делать. Способ определённо не самый простой и требующий определённые навыки. Среди бесплатных можно выделить FreeGate. Эти компании проходят ежегодный аудит на выявление утечек, проверку уровня безопасности и хранения журнала логов. 24dd в обход, shamarc в обход, 24klad, vitalya bro, chem24 и многие другие в обход блокировки Роскомнадзора. Рейтинг:.0 0/5.0 оценка (Голосов: 0) z z - в обход блокировки dd24, z, 24 dd biz, 24dd biz, обход Google PageRank: 0 из 10 Яндекс ТИЦ:. Bitcoin и другие криптовалюты : Surfshark, CyberGhost, AtlasVPN, NordVPN, PIA WebMoney : Surfshark, CyberGhost, NordVPN, me Qiwi : Surfshark, ExpressVPN, AtlasVPN, NordVPN, me YooMoney: me, VPN Monster Apple Pay: Surfshark, CyberGhost, AtlasVPN, NordVPN, PIA. В отличие о указанных выше браузеров с vpn, Tоr работает по другому принципу. Тоr браузер. Будет открываться немного медленнее чем обычно, но тем не менее, сайт открылся и все ссылки на нём отлично работают. Браузерные vpn расширения. Другие бесплатные методы обхода блокировок без vpn, прокси и Тора можно найти в моём следующем посте. Таким образом, собственно можно открывать любые сайты, даже закрытые баннеры и рекламы показываются без помех. Из протестированных нами провайдеров можем выделить ExpressVPN, Surfshark, CyberGhost и Planet VPN. Анонимайзеры. Как пополнить счёт в App Store даже если Mastercard и visa заблокированы, узнайте здесь Google Pay : Surfshark, CyberGhost, AtlasVPN, NordVPN UnionPay : Surfshark, NordVPN, ExpressVPN, me, AtlasVPN Открыть заблоки. Если платежи MasterCard и visa не работают на территории РФ, vpn сервисы предлагают альтернативные варианты платежей. Всем привет. Если РосКомНадзор закрыл какие-то сайты, то на то были какие-то веские причины. Читы для игр. Пожалуй наименее безопасный метод из всех существующих. Значения приведены относительно максимума, который принят за 100. Google PageRank: 0 из 10 Яндекс ТИЦ: 0 Рейтинг:.4 Google Тренды это диаграмма для отслеживания сезонности ключевых слов. Все подробности в разделе Вакансии или у оператора: @daffybiz 24dd. Поменять настройки DNS. Описание возможностей доход Google PageRank: 0 из 10 Яндекс ТИЦ: 10 Рейтинг:.8 0/5.0 оценка (Голосов: 0) Внедрение в ГК РФ понятия «обход закона» t Рейтинг:.8 0/5.0 оценка (Голосов: 0) Rango-hack - форум читеров. Как зайти на заблокированный сайт через Google Translate Так вот, поехали. Рейтинг:.3 0/5.0 оценка (Голосов: 0) 24dd 24dd - Мы открыли круглосуточный телеграм бот в которым вы можете производить покупки: @rc24biz_bot. Рейтинг:.0 0/5.0 оценка (Голосов: 0) - продается. Наиболее защищенным методом является подключение через VPN который не записывает и не хранит историю активности пользователя. Прежде чем выбрать VPN сервис, нужно внимательно отнестись к этому пункту. Населен русскоязычным аноном после продажи сосача мэйлру. Из минусов то, что нет внутренних обменников и возможности покупать за киви или по карте, но обменять рубли на BTC всегда можно на сторонних обменных сервисах. Однако, основным языком в сети Tor пока ещё остаётся английский, и всё самое вкусное в этой сети на буржуйском. Если для вас главное цена, то выбирайте в списке любой, а если для вас в приоритете место товара и вы не хотите тратить много времени тогда выбирайте вариант моментальной покупки. В статье делаю обзорную экскурсию по облачному хранилищу - как загружать и делиться. А если уж решил играть в азартные игры с государством, то вопрос твоей поимки - лишь вопрос времени. Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Исходя из данной информации можно сделать вывод, что попасть в нужную нам часть тёмного интернета не очень-то и сложно, всего лишь необходимо найти нужные нам ссылки, которые, кстати, все есть в специальной Википедии черного интернета. Onion - WWH club кардинг форум на русском языке verified2ebdpvms. Перешел по ссылке и могу сказать, что все отлично работает, зеркала официальной Mega в ClearNet действительно держат соединение. В этом случае, в мире уже где-то ожидает вас выбранный клад. Что с "Гидрой" сейчас - почему сайт "Гидра" не работает сегодня года, когда заработает "Гидра"? На iOS он сначала предлагает пройти регистрацию, подтвердить электронную почту, установить профиль с настройками VPN, включить его профиль в опциях iOS и только после этого начать работу.

Магазин даркнет kraken krakn cc